Leading Architects Think Smaller

Tax breaks pave way for more projects with different scopes

By Jake Indursky | Research By Matthew Elo and Joseph JungerMann

FOR ARCHITECTS, 2024 WAS A TALE IN TWO parts. They spent the first half stuck in the mud as developers waited for housing policy clarity and the second half in a welcome return to form.

“In the second half, we started getting some movement — some market-rate housing, office conversions into housing and different things like that — as people started to learn about these new abatements and new affordability programs,” Aufgang principal Ariel Aufgang said.

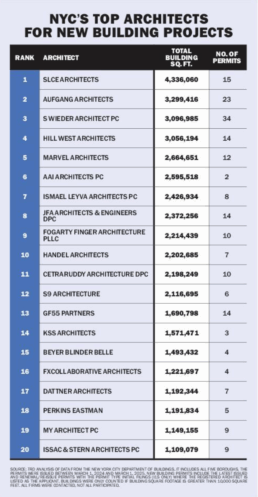

Many of the top firms on The Real Deal’s rankings, which take into consideration the number of permits filed with the Department of Buildings, held onto previous spots. Gensler and SLCE retained their pole positions for alterations and new builds, respectively.

“We did better in 2024 than what we did during Covid and 2023,” said SLCE partner Saky Yakas, whose firm is working on projects like the Flatiron Building conversion and One Times Square.

Despite legislative life rafts, architects confirmed that the new state of play — high interest rates, cost uncertainty and tricky zoning — requires a keener eye. It may mean more business compared to years past, but the scope of architectural projects has changed as developers contort building plans for new tax breaks.

“You have to be a solid developer now for development,” said JFA chief operating officer and partner Ben Grunwald. “You have to know what you’re doing… if you know what you’re doing, at least, you could have a game plan.”

City of “at last”

City of Yes’s passage opened up a world of opportunity for architects. It also opened up a world of work. “Owners immediately wanted us to see what the implications were,” said Yakas, who has already added floors and units and upgraded drawings on three affordable housing projects across Brooklyn and Queens.

The plan’s Universal Affordability Preference, which replaces the city’s Voluntary Inclusionary Program, grants 20 percent density bonuses to projects if all of the extra space is dedicated to permanently affordable housing.

City of Yes also created more housing production opportunities, including loosening of parking minimums and the inclusion of denser R11 and R12 zoning.

CetraRuddy founding principal Nancy Ruddy said that the real driver of business for her firm this year has been office-to-residential conversions, spurred by City of Yes expanding the convertible building stock.

“That has been a major source of work and construction jobs, even clients who have never done renovations and conversions,” said Ruddy, whose firm is working on the nation’s largest conversion, 25 Water Street in the Financial District.

Perhaps more surprising is the surge of office-to-office conversions. Developers are increasingly looking to upgrade existing office buildings as demand for quality office space has surged, according to Kohn Pederson Fox principal Forth Bagley. Manhattan’s first-quarter vacancy rate was 17.7 percent, according to Savills.

The industry also finally got clarity on 485x last year. While the industry breathed a sigh of relief at receiving a fresh tax abatement, architects are now working with developers to adhere to deeper affordability and prevailing wage requirements.

“People are looking for smaller deals — clients that used to build 500-unit buildings are now looking at 100-unit buildings or less,” Grunwald said. Whether that’s good news for architects depends on whom you’re asking.

“It’s counterproductive, frankly,” said Hill West founding partner David West. He said that developers are looking to break sites into multiple smaller buildings when possible, or in the case of one planned 450 unit tower, pausing all together.

Even then, sites being broken up into several buildings requires multiple lobbies, multiple elevator cores, double the management staff and double the application and permit filings for architects, he said. “I think it’s an unintended consequence,” West said. “I don’t think the tax abatement rules should be driving the decision-making.”

Show me the money

Affordable housing projects have proven especially crucial — if they land financing.

“The biggest problem now is there are more projects than there’s funding,” said Curtis + Ginsberg partner Mark Ginsberg, who has a number of projects on hold until clients can get funding.

Architects have found success this year through the city’s efforts to rehabilitate New York City Housing Authority properties through its Permanent Affordability Commitment Together program, which allows land to be leased to developers who complete needed repairs

Aufgang is working with developers on three different projects in the Bronx and Brooklyn where units are being renovated “top to bottom,” he said.

Recently, though, the Trump administration has turned its eye on federal affordable housing funding, which could further threaten many projects’ cash streams.

Despite months of tariff whiplash and stubbornly high interest rates, architects looking ahead feel they have navigated the Covid trough and can visualize the next boom cycle.

“There’s this pent-up need of wanting to develop, we’re seeing a real parallel between what happened after Covid and what happened after the 2008 and 2009 recession,” Ruddy said. “A city like New York always comes back.” TRD